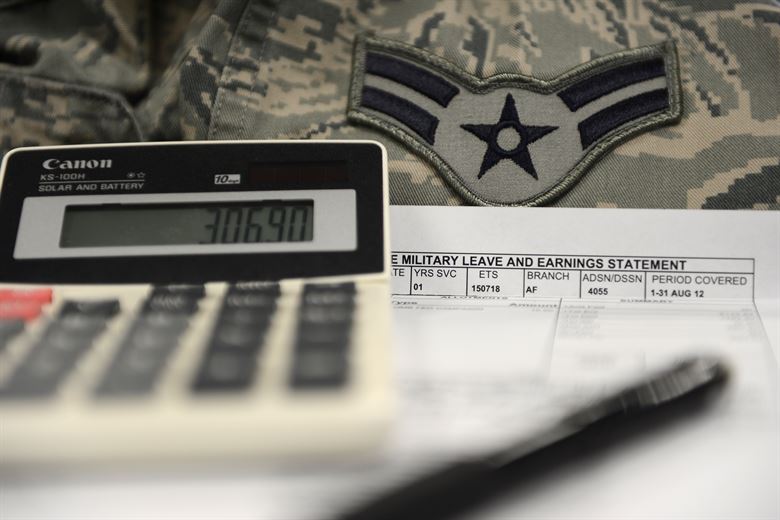

It can be difficult for new service members and their families to wrap their heads around all the variables that can affect your military pay and deductions, but it’s in your best interest to learn as quickly as you can. Once you have a firm understanding of what you can expect in your pay, you’ll be better prepared to deal with issues that may occasionally pop up (like over-payments).

You can find a list of your pay, allowances, and deductions in places like MyPay or on your monthly LES. If you spot something on your LES that you don’t understand, it’s a good idea to bring that issue to your command leadership. They may have a simple explanation, or they may suggest that you take the issue up with your local administration office (IPAC, S1, etc) to be explained or corrected.

Why is it important for every service member to understand their pay?

The United States military is a massive operation that distributes paychecks to around 1.4 million service members twice a month. A great deal of the data entry tied to those dispersed payments is handled internally by other service members, some of whom are also learning the ropes of their jobs–just like you. That means that they’re sometimes prone to making mistakes, and those mistakes can affect how you’re paid.

What happens when you’re over-paid or under-paid?

When a payment for the wrong amount is deposited in your bank account, it’s important to notify your chain of command right away, so corrective action can be taken. Over-payments will be recouped in subsequent pay checks, often all at once unless you work out a payment plan with your command’s administration. Likewise, underpayments can be corrected by adding the missed funds to your next paycheck. However, in some branches, a special payment may be dispersed in emergencies to correct underpayments.

What if you don’t notice an incorrect payment?

It can be easy not to notice getting paid an incorrect amount during hectic times or while your pay is fluctuating due to a PCS move or deployment. If you don’t notice, someone in admin eventually will, either as a part of internal quality assurance efforts, or as a result of an inspection. When over-payments are caught in these ways, that can sometimes be recouped from your next paychecks without notice–and that’s a really crappy surprise to have on payday. This is commonly referred to as a “checkage.”

Avoid being surprised by having your pay checked by staying on top of your pay and ensuring it’s correct each time it’s deposited.

Basic Pay and Allowances

While serving in the military, your basic pay is considered taxable income, while many allowances are not. That means taxes will be deducted from your basic pay, but not from additional allowances aimed at paying for things like housing or food.

Basic Pay

Basic Pay is the primary compensation for service members and is determined by assessing two factors: pay grade and years in service. As mentioned above, basic pay is your primary taxable income. It’s calculated monthly, then cut it half and distributed in two paychecks. Basic Pay can be compared to a salary in a civilian job, meaning it’s not tied specifically to hours, as service members are not eligible for overtime. Basic Pay rate are adjusted annually to coincide with the national Employment Cost Index. In other words, Basic Pay increases each year to coincide with changes in average private sector pay and inflation.

If you’d like to know what you should be receiving for your basic military pay, check out our 2020 military pay charts for officers and enlisted personnel here.

Basic Allowance for Housing (BAH)

Service members that aren’t provided military housing will receive a Basic Housing Allowance (BAH) intended to offset the cost of living in private quarters. As a result, BAH payment rates vary significantly based on a handful of variables: your pay grade, the number of dependents living with you, annual inflation, and the local housing market. This is why you’ll see significantly higher BAH rates for service members stationed in places like San Francisco than you will in more rural duty stations. The BAH rate is meant to provide an E3 with two dependents (as one example) with roughly equal housing accommodations regardless of varied housing markets throughout the country.

Service members also sometimes receive something called BAH Type II, which is an in-transit rate for housing between duty stations.

Want to find out what the exact BAH rate is for your appointed place of duty? Check out this BAH Calculator provided by the Defense Travel Management Office.

Basic Allowance for Subsistence (BAS)

BAS (sometimes called ComRats by us old timers) is an allowance given to service members that don’t have their meals provided by a mess or chow hall. Technically speaking, all service members receive BAS, however, those who are issued a meal card to eat in military facilities are often checked the total value of BAS in exchange for their meal services. BAS Rates are based on feeding the single service member, and are not affected by the number of dependents a service member has.

Service members received a .90% increase in BAS for 2020.

The 2020 Enlisted BAS Rate is $372.71 per month.

The 2020 Officer BAS Rate is $256.68 per month.

Other Common Allowances

Some additional allowances are issued to service members on an annual basis or only under certain circumstances. Some common examples are:

- Military Clothing Allowance – Both officers and enlisted service members receive an initial clothing allowance, and enlisted service members receive an additional clothing replacement allowance once per year to cover replacing items that get worn out. This allowance is paid out on the anniversary of the service member’s enlistment each year.

- Dislocation Allowance is a partial reimbursement aimed at offsetting the costs associated with moving under orders.

- Family Separation Allowance (FSA) is a $250 monthly allowance given when service members are separated from their families by orders for more than 30 days.

- Family Subsistence Supplemental Allowance is provided to service members that are struggling through difficult economic circumstances that are outside of their control.

Special and Incentive Pay (S&I Pay)

S&I Pay is additional pay given to service members that have specific skills or who are working under specific circumstances. These additional payments are intended to help make military pay competitive with the civilian sector even in specialized situations.

- Hardship Duty Pay (HDP) is given to service members assigned to areas of the world with an exceptionally low standard of living (as compared to the United States).

- Hostile Fire Pay/Imminent Danger Pay is given to service members assigned to areas of the world where they may be subject to he hostile actions of a foreign enemy.

- Assignment Incentive Pay is given to service members on extended tours in unusual and specifically needed assignments.

- Hazardous Duty Incentive Pay is given primarily to service members in specific types of flying or parachute jumping assignments. It’s often referred to as “Flight Pay” among pilots.

Deductions and Allotments

Just like with any job, there are a number of things that come out of your pay before you receive it. These deductions include things like taxes, social security, and medicare, alongside deductions for military programs you may have enrolled in. Here’s a breakdown of some common deductions you may come across.

Social Security – Just like with any job, Social Security deducts 6.2% of your taxable income. This means Social Security only comes out of your Basic Pay.

Medicare – Like Social Security, your Medicare deduction is based only on your Basic Pay. Medicare deductions are 1.45% or your taxable income.

Service Member Group Life Insurance (SGLI) – If you opted in for low-cost life insurance through the military, you will be charged for it out of your Basic Pay. SGLI rates are seven cents for every $1,000 in coverage you elect, so full coverage of $400,000 in life insurance will reflect as a $28 monthly deduction. If you opt for less coverage, the deduction will also be smaller.There will also be an additional $1.00 per month added for Traumatic Injury Protection coverage (TSGLI).

Armed Forces Retirement Homes – All active duty enlisted and warrant officers serving in the Marine Corps, Army, Navy, or Air Force is charged $0.50 per month to support Armed Forces Retirement Homes.

Family Servicemembers Group Life Insurance (FSGLI) – Service member’s families are automatically enrolled in the FSGLI unless the member declines the coverage. FSGLI Rates for service members that are under 35 are $5.00 per month for $100,000 of coverage (if the service member selects a lower coverage rate, a smaller deduction will be applied).

Thrift Savings Plan (TSP) – Service member contributions to the TSP are reflected as deductions to your military pay on your LES, then credited to your TSP account on the following month.

Any Military Debts – Checkages for over-payments will reflect as debts on your LES.

Allotments – Allotments are a great way to stay on top of recurring expenses and can be set up through MyPay or by submitted a DD Form 2558 through your command’s administration. Allotments will reflect on your LES as a deduction from your pay.

Feature image courtesy of the U.S. Marine Corps